Clouds of data dance in patterns, helping company-runners analyze competitive dynamics in their collective worlds. Finding cross-correlations helps to understand any variables that might be related to one another.

A simple correlation involves looking for similarities in a same time period, but in a cross-correlation, two sets of random variables can be from different time periods. Hence the "cross" in there, i.e. across time.

For example, is there a relationship between zip codes and how much people spend on buying expensive cars? Or perhaps between people who buy tents and also buy hiking boots?

There is most likely no correlation between barrels of corn produced and the number of oranges consumed.

Related or Semi-related Video

Finance: What is Inverse Correlation?1 Views

Finance Allah Shmoop What is inverse correlation All right It's

the relationship between two variables where we can expect an

increase in one variable to be paired with a decrease

in another variable Alright in plain English correlation When it

rains you get wet Inverse correlation When it rains you

get dry Correlation You have a big brain So your

smart inverse correlation like we're thinking dinosaurs Maybe they had

big brains all of it But if they had big

brains the bigger their brain Well the dumber thing God

Well that would be an inverse correlation right Correlation You

drive a fast flashy cars so you probably have a

small garage Alright Inverse correlation You drive a fast flashy

car and everything else about you is enormous Yeah So

in a word in versus just opposite check out inverse

correlations in this table showing to data sets Note how

the returns on investment in gold increase while the returns

on investment in Pat's for cats decrease over the same

timeframe And instead of hats for cats you could have

seen the stock market because people typically retreat into gold

when they're nervous about equities So this is really not

a bad inverse correlation right Okay So let's take a

look at a scatter plot of the same two data

sets See how the data points get lower and lower

as we go farther to the right Yeah that's because

the X values or the returns on the gold investment

increase or go farther to the right Well then the

Y values or returns on the hats for cats equities

investment decrease or go closer to the Y axis Well

sometimes we want to put a number on how strong

or weak The inverse correlation is between any two pairs

of variables So basically we're trying to determine if the

inverse correlation is one that follows a very steady amount

of decrease in one variable for a fixed amount of

increase in the other or if the amount of decrease

in one variable fluctuates for a fixed increase in the

other or more simply how closely the points on the

scatter plot are to an imaginary line like this thing

that best represents them Right That's an r squared correlation

there we'll get to it So the measure of how

strong the correlation is between these two variables is called

yes the correlation coefficient or our value Well a strong

inverse correlation would have the data points all cozied up

to the best fitting line coincidently called the line of

best fit Kind of like all of your new you

know friends after you win the ninety million dollars Powerball

lottery Well a week inverse correlation would have the data

spread out away from the line and best fit So

there's really no clustering here It's just a whole bunch

of dots on a graph that don't really tell you

much of anything you know like the location of kids

at a middle school dance compared to the location of

the dance floor So how do we find the our

value to determine how strong our correlation is inverse or

otherwise Well typically people use some sort of technological gadgets

such as a graphing calculator spreadsheet or a nap Let's

take that investment data from before comparing Gold returns to

returns on equity and hats for cats and walked through

how you'd find the R value using a spreadsheet So

open your favour like Excel or Google sheets or OpenOffice

Cal Core sells for days or and whatever you use

We're using Excel for this demo but they all work

in basically the same Put the data for the gold

returns without the presented signs in the first column Put

the data from hats for cats also without the presented

signs In the second column like that go to any

blank cell like the top selling the third column C

one there Then click on the formula's tab Choose the

Mohr Functions button and Anju Statistical See the coral option

there you selected Once we choose correlation we'll get a

pop up asking us to define the two sets of

data highlight on ly the first column of data It

should load that set of cells in the top row

of the pop up All right now left Click in

the second row of the pop up Highlight on ly

the second column of data and well should slide those

cells right into place Got it Okay So click okay

and boom instant our value Well it should show up

in the cell you picked to enter the Correlation Command

See one If you followed our Russians to et You

know t looks like our correlation has the strength of

negative point eight four Oh one Okay But like what

does that mean Is that strong or weak Positive Negative

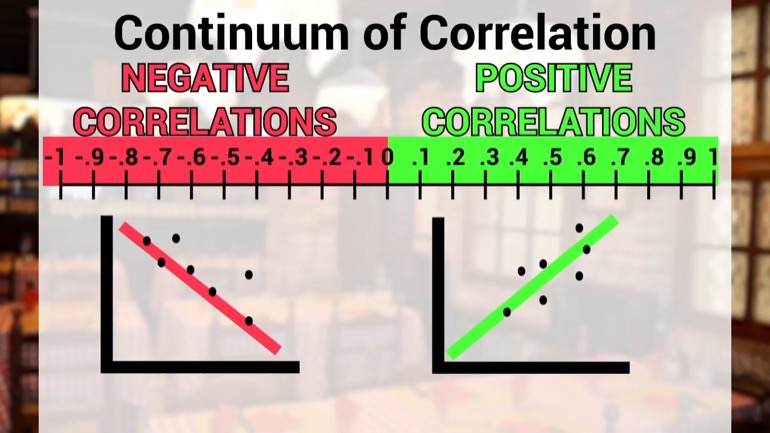

Well for inverse correlations there's a range of values between

zero and negative one that we consider strong medium and

weak Inverse correlations like strong inverse correlation is generally run

from about negative point seven The negative one These will

be scatter plots where the points are quite close to

the best fit line like they're extremely counter or inversely

correlated Like if you found that every guy over forty

who drove a red convertible portion wore a gold chain

necklace there had a really big garage well then it

would be negatively correlated to our expectations Okay medium inverse

correlation is generally run from about negative point For the

negative point seven seas will be scattered plots with points

group less closely around the line A best fit Think

about it like well maybe half to two thirds of

all the guys have a small garage versus a big

garage Yeah something like that Weak inverse correlation is generally

run from well zero toe negative point for easily scatter

plots with almost no riel tight grouping Maybe there's some

trend if you really study it hard and think about

Roar Shack But there's really no correlation between the size

of your garage and when you're driving a convertible red

portion you wear a gold chain necklace All right one

thing we have to be careful about With the inverse

correlation XYZ thie implied value judgments that mistakenly get applied

to the two variables that are inversely correlated like in

our correlation calculation on returns we saw the gold investment

rise while the equity in hats for cats investment had

decreasing returns and basically was saying that people retreated putting

there cash into gold when they were nervous about the

equity markets Well that doesn't mean gold will always be

the one to increase While hats for cats decreases Beyond

the obvious changes in the market that might make gold

suddenly tank an inverse correlation means that gold could be

the investment with decreasing returns While hats for cat shows

increasing returns right the correlation thing is just showing that

they're inversely correlated When one goes up the other goes

down It could be that well when one goes down

the other one goes up Got it by the biggest

takeaway smelling That inverse correlation means that as one variable

increases in general the other variable decreases particularly when you

have high R squared correlations there Also we can calculate

how strong the correlation is by finding the R value

which we typically do using some technological do Dad Yeah

thank you Google Sheets and excel in all that stuff

Inverse correlation Czar values run from zero to negative one

with strong being in close to negative one in week

being close to zero And we're hoping there's an infamous

correlation between the number of matches we get on tinder

and the number of dates when we get that in

badly But well so far the data is not backing 00:06:41.135 --> [endTime] us up Change our picture what Oh

Up Next

What are correlation coefficients? Correlation coefficients are calculated variances between two variables within a given time period. As variable...